Simple Cashback. No Annual Fee.

The Chase Freedom® Credit Card remains one of the most popular no-annual-fee cashback cards in the U.S. for a reason: it’s flexible, easy to use, and surprisingly powerful when optimized correctly.

In 2026, the card continues to attract consumers who want solid cash back without tracking points or paying fees, while still benefiting from a strong issuer and competitive intro offers.

Below is a clear, no-fluff breakdown of how it works, who it’s for, and whether it deserves a spot in your wallet.

Key Benefits

- $0 annual fee

- 5% cash back on rotating quarterly categories (up to the cap)

- 3% cash back on dining and drugstores

- 1% cash back on all other purchases

- 0% intro APR on purchases and balance transfers (limited time)

- Rewards earned as Ultimate Rewards® points

- Issued by a top-tier U.S. bank

No gimmicks. No complicated redemption rules.

How Cashback Works

The Chase Freedom uses a tiered rewards structure:

- Each quarter, Chase releases 5% bonus categories (activation required)

- Eligible spending earns 5% up to the quarterly limit

- Dining and drugstores earn a flat 3%

- Everything else earns 1%

- Rewards can be redeemed as cash back or statement credits

Advanced users can also combine rewards with other Chase cards to unlock higher redemption value — a feature most beginners overlook.

Who This Card Is Best For

This card works best if you:

- Have good to excellent credit (typically 670+ FICO)

- Want high cash back without an annual fee

- Are willing to activate quarterly categories

- Prefer flexibility over airline-specific points

It’s especially attractive for:

- Budget-conscious households

- Young professionals

- Cashback optimizers

- People pairing cards strategically

You will remain in the current site

Pros and Cons

Pros

- Strong earning potential for a no-fee card

- Trusted issuer with excellent app and customer service

- Flexible redemption options

- Competitive intro APR offer

Cons

- Rotating categories require activation

- 5% rewards are capped quarterly

- Not ideal for people who prefer “set-and-forget” cards

Chase Freedom vs Popular Alternatives

| Feature | Chase Freedom® | Freedom Unlimited® | Discover it® |

|---|---|---|---|

| Annual Fee | $0 | $0 | $0 |

| Bonus Categories | 5% rotating | No | 5% rotating |

| Dining Rewards | 3% | 3% | 1% |

| Intro APR | Yes | Yes | Yes |

| Issuer Network | Visa | Visa | Discover |

Bottom line: Chase Freedom offers higher upside for users willing to activate categories, while Unlimited favors simplicity.

Hidden Value Most Users Miss

Many cardholders don’t realize Chase Freedom rewards are earned as Ultimate Rewards points, not fixed cash.

That means you can:

- Combine points with premium Chase cards

- Transfer rewards for higher travel value

- Stretch cash back far beyond 1 cent per point

This flexibility is rare in a no-annual-fee card.

Final Take

The Chase Freedom® Credit Card continues to be one of the best no-fee cashback cards in 2026 — especially for users who want flexibility now and optional upgrades later.

👉 See if you qualify for Chase Freedom® today and check current offers directly from Chase.

You will remain in the current site

Discover it® Cash Back Review 2026: A No-Fee Card That Still Delivers Outsized Value <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>An updated, real-world look at rewards, Cashback Match™, strengths, limitations, and ideal users in 2026.</p>

Discover it® Cash Back Review 2026: A No-Fee Card That Still Delivers Outsized Value <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>An updated, real-world look at rewards, Cashback Match™, strengths, limitations, and ideal users in 2026.</p>  Tomo Credit Card Review 2026: A Credit Card Without Credit Checks, Interest, or Fees <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>A practical option for building U.S. credit without a score, deposits, or hidden costs.</p>

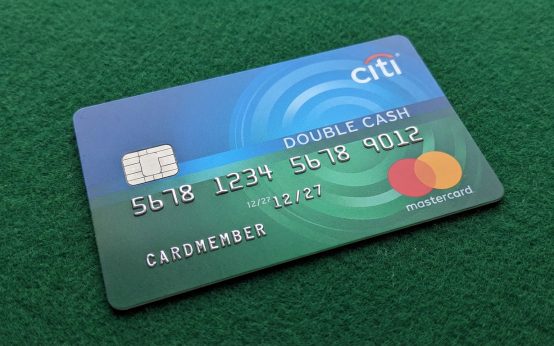

Tomo Credit Card Review 2026: A Credit Card Without Credit Checks, Interest, or Fees <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>A practical option for building U.S. credit without a score, deposits, or hidden costs.</p>  Citi Double Cash® Card Review 2026: A Simple 2% Cash Back Card That Still Makes Sense <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>An honest look at how the 2% cash back works, who benefits most, and whether this card still earns its place in 2026.</p>

Citi Double Cash® Card Review 2026: A Simple 2% Cash Back Card That Still Makes Sense <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>An honest look at how the 2% cash back works, who benefits most, and whether this card still earns its place in 2026.</p>